Time Interest Earned Ratio Interpretation

From 2008 to 2010 Revenues increased by 558 64306 in 2010 versus 60909 in 2008. Earnings per share ratio formula.

Times Interest Earned Ratio Meaning Formula Calculate

Definition of Debt Coverage Ratio.

. If a firm has normal times interest earned ratio it has lesser risk of not being able to meet its interest obligation. Could be considered a solvency ratio. A ratio of 21 or.

A ratio of 1 is usually considered the middle ground. For example if a companys earnings before taxes and interest amount to 50000 and its total interest payment requirements equal 25000 then the. The current ratio formula below can be used to easily measure a companys liquidity.

The Current Ratio formula is. The interest coverage ratio interpretation suggests the higher the ICR the lower the chances of defaultsThus lenders look for a significant ratio to ensure they do not get ditched during the loan term. CFIs Financial Analysis Fundamentals Course.

The debt to equity ratio also describes how much shareholders earn as part of the profit. Current ratio is a useful test of the short-term-debt paying ability of any business. Its not risky but it is also not.

The times interest earned ratio of PQR company is 803 times. As long as enough profits are being generated to do so then a borrower is judged to be a reasonable credit risk. EBIT is sometimes called Operating Income.

The most common of these ratios are the debt to equity ratio and the times interest earned ratio. Although the ratios may vary for different industries most commonly higher ratios are preferable. The ra-tio indicates how many times a company could pay the interest with its before tax income so obviously the larger ratios are considered more favorable than smaller ratios.

Times interest earned ratio is very important from the creditors view point. Interpretation of Earnings per share ratio. The current ratio is 275 which means the companys currents assets are 275 times more than its current liabilities.

Cash 15 million. However this analysis does not address. This ration variation calculates the.

And unlike net income it is difficult to play around with this variation of earnings per share ratio. The times interest earned ratio calculates the number of times that earnings can pay off the current interest expense. A ratio analysis is a quantitative analysis of information contained in a companys financial statements.

Since the working capital ratio measures current assets as a percentage of current liabilities it would only make sense that a higher ratio is more favorable. Cash earnings per share ratio Operating Cash FlowDiluted Shares Outstanding 5. A WCR of 1 indicates the current assets equal current liabilities.

When this ratio is high it indicates the sound financial health of the company which ensures lenders of easy interest payments throughout the loan tenure. Analysis-The times interest ratio is stated in num-bers as opposed to a percentage. A high ratio indicates that a company can pay for its interest expense several times over while a low ratio is a strong indicator that a company may.

It means that the interest expenses of the company are 803 times covered by its net operating income income before interest and tax. It gives the exact amount of cash earned. This measurement is used by creditors lenders and investors to determine the risk of lending funds to a company.

It is important to note that a higher Interest Coverage Ratio is a. A high ratio ensures a periodical. This ratio using the averages of the balance sheet accounts to facilitate our ratio decomposition.

Current ratio Current assetsCurrent liabilities 1100000400000 275 times. Book Value earnings per share ratio. In other words a ratio of 4 means that a.

EB optimal capital structure PG HA Times interest earned TIE EBIT Interest expense Ability to meet interest payments as they mature. If a business holds. Ratio analysis is used to evaluate various aspects of a.

Current Ratio Current Assets Current Liabilities. However Interest Coverage Ratio decreased from 1955 times in 2008 to 963 times in 2010. Example of the Current Ratio Formula.

The interest coverage ratio measures the ability of a company to pay the interest on its outstanding debt. PG HA ROT minimal 2-4 CFO to interest. Debt Coverage Ratio can be defined as a ratio that is calculated in order to measure the ability of an organization in clearing off all the debt obligations on time or in other words it is the comparison of a companys level of cash inflows to its current total debt obligations and it is calculated by dividing the net operating profits earned by an.

Times Interest Earned Earnings for the Year before Interest and Income Tax Expense Interest Expense for the Year. High debt to equity ratio means profit will be reduced which means less dividend payment to shareholders because a large part of the profit will be paid as interest and fixed payment on borrowed funds.

Times Interest Earned Ratio Debt To Total Assets Ratio Analyzing Long Term Debt Youtube

Times Interest Earned Ratio Formula Examples With Excel Template

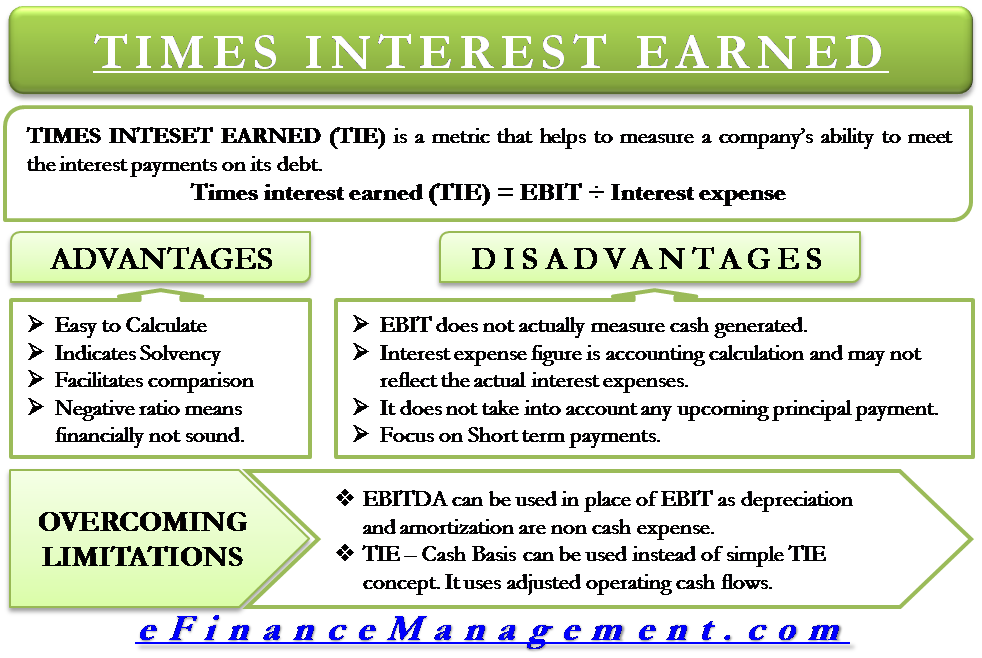

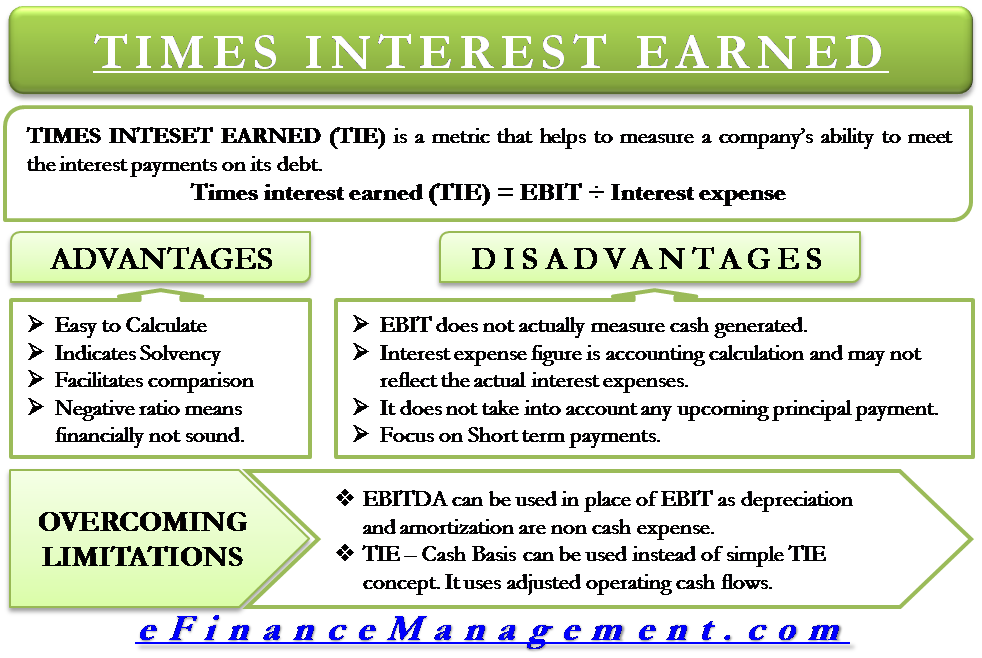

Times Interest Earned Formula Advantages Limitations

Times Interest Earned Tie Ratio Formula And Calculator Excel Template

0 Response to "Time Interest Earned Ratio Interpretation"

Post a Comment